The Digital Operational Resilience Act (DORA) directs that financial institutions must achieve cyber resilience by January 2025. Our Hexnode UEM + XDR unified solution currently is the fastest path to continuous compliance and proactive threat response across all endpoints.

With 38% of firms targeting full compliance in 2026, the time for integrated action is now. Implementing a Zero Trust model by deploying the DORA-Baseline-Policy can be an actionable step in UEM. Operational resilience is no longer a cost of doing business; it is the business. Discover how our unified platform simplifies your entire ICT risk management framework.

- Digital Operational Resilience Act (DORA) and the new era of financial cyber resilience

- Understanding the Digital Operational Resilience Act (DORA)

- Why compliance alone isn’t enough — The case for cyber resilience

- Challenges financial institutions face on the road to DORA

- The role of XDR in DORA readiness

- The foundational layer — UEM for endpoint compliance and control

- Building a unified DORA readiness framework with Hexnode UEM + XDR

- Best practices for DORA compliance using UEM + XDR

- Measuring success — From compliance to confidence

- Unifying prevention and response for DORA 2026

- FAQs

Digital Operational Resilience Act (DORA) and the new era of financial cyber resilience

The Digital Operational Resilience Act (DORA) is the EU’s critical mandate. It brings forth uniform rules for the Information and Communication Technology (ICT) resilience of the entire financial sector.

Hexnode UEM + XDR is uniquely delivering this compliance by unifying endpoint prevention and cross-layer threat detection into a single, proactive framework.

Started from January 17, 2025, the Digital Operational Resilience Act was enforced, impacting everything from banks and insurers to FinTech’s, payment providers, and critical third-party ICT service providers. DORA aims to ensure financial organizations can prevent, withstand, and recover from ICT-related disruptions through unified cyber resilience.

The urgency is undeniable due to threats where the average cost of a data breach in the financial industry has soared to $6.08 million. The risks are clear: escalating ransomware attacks, complex supply-chain vulnerabilities, and the growing threat of regulatory action. As the new mandate states, penalties can reach up to 2% of the total annual worldwide turnover for critical failures in risk management.

This is why proactive ICT risk management is key. Our thesis is that true DORA compliance and cyber resilience for banks requires moving beyond siloed security tools. Hexnode simplifies this complex undertaking by offering a unified console for both UEM and XDR, allowing security teams to manage policy compliance and respond to threats without switching platforms.

Understanding the Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act is built on five core pillars, demanding a holistic, organization-wide approach to managing and responding to ICT-related risks. Compliance is a mandate to integrate preventative security controls (UEM) with proactive threat response capabilities (XDR) across all critical operations.

Core pillars of DORA

DORA shifts the regulatory focus from just ensuring financial stability to ensuring digital stability. The regulation is structured around five non-negotiable pillars that govern a firm’s entire ICT lifecycle and define modern financial cybersecurity:

- ICT risk management: Requires continuous risk assessment, protection strategies, and robust ICT architecture.

- Incident reporting and logging: Standardizes the classification, logging, and mandatory communication of all major ICT-related incidents to relevant authorities.

- Digital Operational Resilience Testing: Mandates proactive testing, including advanced threat-led penetration testing (TLPT).

- Third-party risk oversight: Extends stringent requirements to critical ICT third-party vendors, making financial institutions responsible for the resilience of their supply chain.

- Information-sharing requirements: Encourages financial entities to share information and intelligence on cyber threats and vulnerabilities to collectively enhance sector resilience.

In the age of digital dependence, resilience must be architected, not hoped for. This is the mandatory digital resilience culture DORA enforces.

What DORA means for financial institutions

For any financial institution operating in the EU, the Digital Operational Resilience Act translates into a complete overhaul of how ICT risk is governed and managed.

- It demands continuous monitoring of ICT risks and vulnerabilities across all endpoints, a core function of Hexnode UEM.

- It mandates centralized incident documentation and reporting, requiring a single pane of glass for logging all security and operational failures.

- All recovery and continuity planning must be regularly validated through audits and resilience testing.

Hexnode’s UEM console acts as the single source for device compliance status, configuration management, and patching, which is essential for maintaining a strong cyber resilience for banks.

Compliance timeline and key deadlines

The Digital Operational Resilience Act passed in 2023, and full enforcement began on January 17, 2022. This leaves a crucial phase from 2024–2025 to completely restructure frameworks, conduct mandatory resilience testing, and evaluate vendor contracts.

Given that a recent survey found 55% of financial institutions globally are not prepared to meet DORA’s implementation deadline, urgency is paramount. Mapping all critical ICT systems and third-party vendors to DORA’s requirements includes deploying the pre-configured DORA ICT Vendor Vetting Profile straight from your Hexnode console, allowing you to automate essential vendor compliance checks.

Don’t wait for the deadline, read our next section to see how Hexnode UEM + XDR delivers tangible solutions for each DORA pillar today.

Simplifying Compliance: An Actionable Guide for IT

Stop guessing about compliance. Learn the critical steps your organization must take and how Unified Endpoint Management (UEM) is essential for automating controls, mitigating risks, and achieving continuous compliance across all endpoints.

DownloadWhy compliance alone isn’t enough — The case for cyber resilience

Achieving DORA compliance is the foundation, but true operational continuity requires building proactive, continuous cyber resilience that withstands evolving threats.

The limits of checklist compliance

Many institutions focus purely on regulatory boxes, viewing the DORA as just another compliance task. But, simply documenting risk frameworks and logging incidents does not prevent a breach.

The real danger lies in the average time to identify and contain a breach in the financial sector is a staggering 223 days. This gap shows that mere DORA compliance is not resilience. A breach of one critical vendor or unpatched endpoint can still trigger a cascading, multi-system disruption.

The business value of continuous resilience

The proactive stance of moving beyond compliance to continuous resilience leads to improved customer trust, strengthened regulatory standing, and dramatically reduces breach recovery costs and downtime.

Crucially, a unified platform like Hexnode UEM + XDR enhances cross-department accountability for ICT risks, ensuring security teams and business leaders work from the same trusted data.

Hexnode’s unified console simplifies the journey to true cyber resilience for banks by allowing UEM and XDR data to trigger immediate, contextual responses, accelerating your MTTC and ensuring operational continuity.

Discover how we turn DORA requirements into a strategic business advantage.

Challenges financial institutions face on the road to DORA

The path to achieving DORA-aligned cyber resilience is often blocked by inherited ICT fragmentation, reliance on manual processes, and critical endpoint visibility gaps.

Fragmented ICT environments

With organizations in the financial sector using an average of 110 security tools, the fragmentation is clear. Each vendor offers limited visibility, making the DORA requirement for unified oversight and holistic ICT risk management nearly impossible.

When an incident occurs, security teams waste critical minutes manually correlating data across disparate consoles, directly increasing incident dwell time and violating DORA’s swift recovery goals.

Manual compliance processes

The Digital Operational Resilience Act demands continuous monitoring of ICT risks, a stark contrast to the static, yearly audits many firms still rely on.

Manual compliance processes, where device configurations and access controls are checked quarterly, leave the firm exposed for months. This lack of automated remediation and real-time posture assessment means incidents are only detected long after they begin, accelerating regulatory risk and preventing true DORA compliance.

Endpoint blind spots

Endpoint blind spots like unmanaged mobile devices, weakly configured workstations, and delayed patching schedule remain the leading breach vectors for financial cybersecurity. Without a dedicated UEM solution, compliance gaps proliferate, directly threatening cyber resilience for banks. You can instantly execute this discovery using the Execute-Inventory-Discovery command through the Hexnode console to eliminate blind spots and ensure every asset adheres to its security baseline.

The following section speaks of how a unified approach eliminates these risks.

The role of XDR in DORA readiness

Extended Detection and Response (XDR) is the critical technology layer that enables financial institutions to achieve DORA’s mandates for continuous threat detection, rapid response, and operational recovery.

Continuous threat detection and response

The shift required by DORA compliance is a shift toward continuous detection. XDR is the engine for this change. It combines telemetry holistically across endpoints, networks, cloud environments, and identity layers. This unified data stream allows security teams to see the full attack chain, not just isolated events.

This comprehensive visibility directly satisfies DORA’s core requirement for continuous detection and incident reporting across the entire ICT framework.

Automated incident triage and forensics

XDR excels at immediate action and flawless documentation by centralizing investigation and automatically collecting crucial forensic evidence for regulatory reports. The speed is transformational: companies using XDR solutions have reported reducing their Mean Time to Respond (MTTR) by an average of 70%.

By automating the evidence collection process, Hexnode XDR ensures that the standardized reporting demanded by DORA’s ICT risk management pillars is instantaneous and comprehensive.

Strengthening resilience and recovery

True cyber resilience for banks is measured by the ability to recover, not just the ability to protect. XDR dramatically strengthens resilience by offering immediate, automated containment capabilities.

The capacity for rapid isolation is fundamental to meeting DORA’s stringent business continuity standards, which prioritize the continuous availability of critical services.

The Hexnode XDR advantage

Hexnode XDR is built directly upon the foundation of our UEM, ensuring that all policy configurations and device compliance data feed directly into the detection engine. This tight integration means your XDR response is always contextually aware of device state, drastically reducing false positives and accelerating your recovery efforts.

Our unified console provides the single pane of glass required for comprehensive financial cybersecurity oversight and simplified DORA compliance.

Learn exactly how our combined solution works in the next section.

The foundational layer — UEM for endpoint compliance and control

UEM is a much-needed layer of prevention, guaranteeing that all devices accessing critical ICT systems meet DORA’s strict security and configuration requirements. Hexnode UEM automates the entire device lifecycle, providing the granular control necessary to enforce compliance across mobile, desktop, and IoT devices.

1. Endpoint visibility and configuration enforcement

- The DORA requires high ICT risk management starting at the asset level. Specifically, DORA Articles 6 and 7 require ongoing monitoring of all ICT assets and the implementation of robust protection and prevention measures.

- Hexnode UEM provides real-time posture tracking, immediately reporting encryption status, patch status, and unauthorized configurations.

- UEM automates device configuration, reducing human error by large and enforcing a hardened security baseline.

It’s the only way to eliminate the blind spots that threaten financial cybersecurity.

2. Policy automation and audit readiness

- For compliance officers, the ability to prove resilience is as important as achieving it.

- UEM provides centralized enforcement of access policies, app restrictions, and mandatory OS updates, ensuring consistency regardless of device type or location.

- Furthermore, Hexnode UEM generates immutable, audit-ready compliance reports for regulators, ensuring full traceability of every endpoint action or configuration change.

This level of automated documentation streamlines the audit process required for DORA compliance and proves the continuous nature of your security framework.

3. Integration with XDR for full resilience

- UEM and XDR are two halves of DORA resilience. UEM provides the prevention layer (device hygiene and control) and XDR delivers the detection and automated response layer.

- Hexnode being an integrated platform makes this seamless: when a non-compliant device is detected by UEM (e.g., encryption disabled), the platform can automatically trigger a lockdown; simultaneously, the XDR component correlates any related threat and executes automated isolation if necessary.

This foundational layer prepares your institution for full-spectrum cyber resilience for banks.

Building a unified DORA readiness framework with Hexnode UEM + XDR

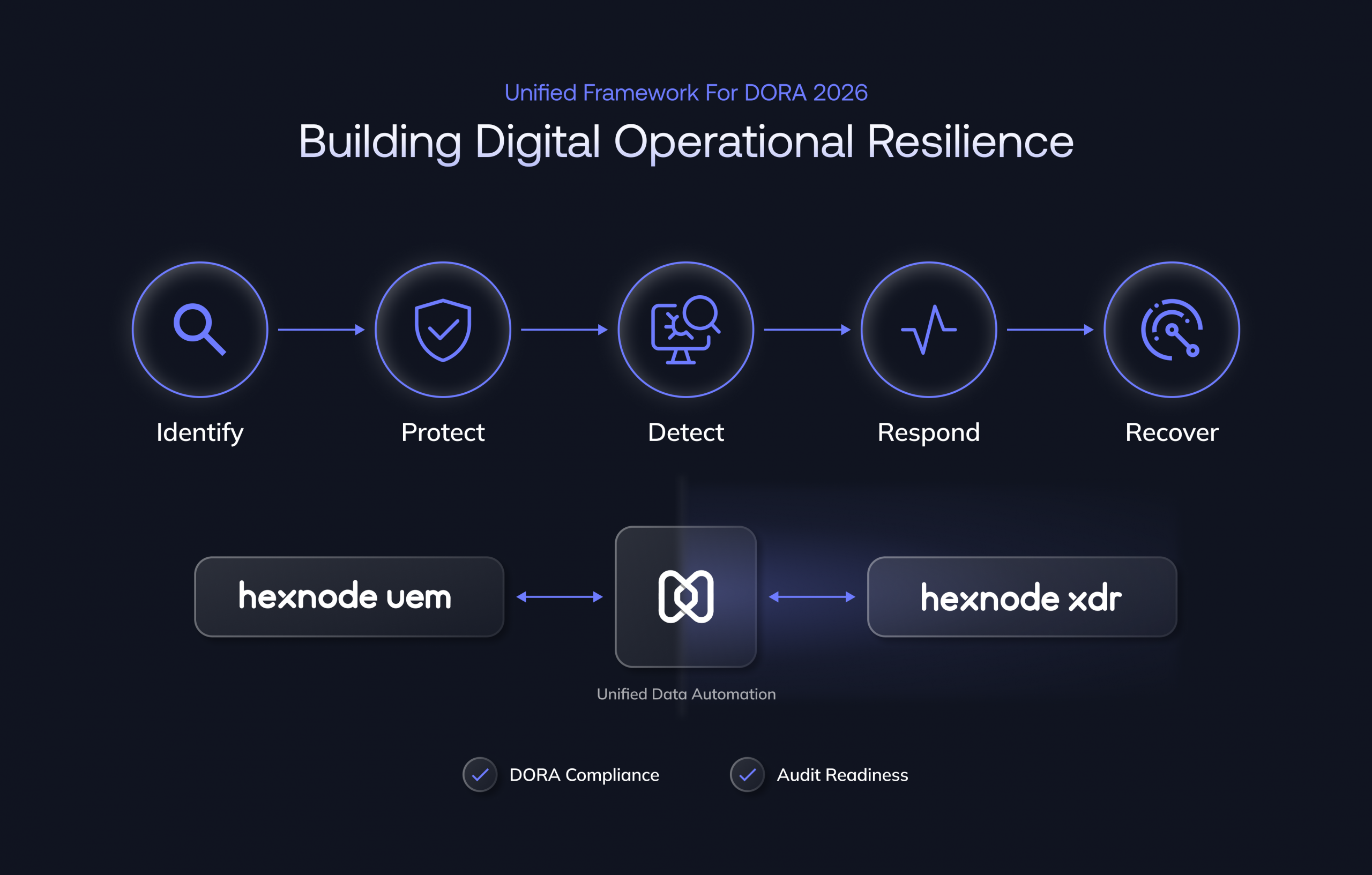

The most effective strategy for meeting the Digital Operational Resilience Act in 2026 is unifying prevention and response into one smooth, automated framework: Hexnode UEM + XDR.

Unified visibility & governance

DORA’s complexity demands simplification. Our unified solution provides the single pane of glass that regulators and SOC teams need for complete oversight. Hexnode UEM manages the Identify and Protect stages, confirming policy compliance, asset inventory, and configuration.

Hexnode XDR manages the Detect and Respond stages correlating threats across the infrastructure. This combined UEM + XDR dashboard eliminates the fragmented ICT environments, speeding up incident triage and ensuring centralized ICT risk management documentation.

Automated compliance enforcement

Automation is the key to both cost efficiency and rapid resilience. Hexnode UEM enforces security and access policies. Hexnode XDR, however, continuously validates endpoint status against threats, reporting incidents aligned with DORA metrics. This powerful automation is financially critical: companies using security automation report a cost difference of $3.85 million less per data breach compared to those without.

Continuous testing and improvement

The true measure of cyber resilience for banks is validated through testing. Hexnode fully supports Digital Operational Resilience Testing (DORT), fulfilling the requirement to validate your firm’s ability to withstand and recover from severe disruptions. This integration enables simulated breach testing, automated incident validation, and real-time policy updates.

By leveraging Hexnode UEM + XDR, you transition from simply preparing for DORA to building a resilient, future-proof financial institution.

Best practices for DORA compliance using UEM + XDR

Achieving DORA compliance requires adopting a lifecycle approach that seamlessly integrates the preventative control of UEM with the automated response capabilities of XDR.

Here are the critical steps financial institutions must take:

- Conduct an ICT Risk inventory: Use Hexnode UEM to trace each endpoint, app, and third-party vendor accessing your systems, establishing a baseline for ICT risk management.

- Enforce security baselines with UEM: Apply foundational policies like encryption and Multi-Factor Authentication (MFA) enterprise wide. MFA has been credited with a 98% reduction in account takeover attacks.

- Integrate XDR for real-time threat visibility: Accumulate telemetry from all infrastructure layers into Hexnode XDR.

- Automate incident reporting: Align escalation workflows with DORA’s strict response timelines. Leverage the centralized reporting in Hexnode UEM + XDR to automatically generate auditable reports ensuring regulatory accountability.

- Continuously test and audit: Simulate incidents quarterly and refine resilience metrics.

Implement automated, quarterly breach simulation tests across your most critical ICT functions. This unified approach drastically simplifies the journey to continuous DORA compliance.

Measuring success — From compliance to confidence

The ultimate goal of DORA readiness is to prove operational resilience through measurable performance improvements. Hexnode UEM + XDR provides the unified metrics necessary to quantify this success and generate confidence across stakeholders.

Success in DORA compliance is measured in reduced risk and faster recovery. Our customers who unify their security stack see dramatic, quantifiable gains: integration of Hexnode XDR, for example, results in a 40% reduction in Mean Time to Detect (MTTD), a vital metric for DORA’s incident reporting pillar.

With improved cyber resilience for banks, you benefit from reduced potential downtime and quick recovery, securing improved stakeholder trust and regulatory standing. The Hexnode console centralizes all necessary evidence, resulting in high regulatory audit readiness.

Hexnode simplifies the proof of performance by aggregating all metrics into one view, generating a real-time DORA score visible in the DORA-Compliance-Confidence-Score dashboard.

Unifying prevention and response for DORA 2026

The DORA is clearly changing the standard of financial cybersecurity, demanding continuous, verifiable operational resilience by January 2026. Hexnode UEM + XDR offers the industry’s most unified solution, bridging the gap between endpoint compliance and proactive cross-layer threat detection.

The 2026 deadline is almost here, and with some of the institutions still unprepared DORA marks a mandatory shift from isolated security products to a unified resilience framework.

Hexnode bridges the gap with UEM enforcing baseline compliance, implementing every asset to security policies, while XDR drives proactive detection and automated response across the entire infrastructure.

Prepare for DORA 2026 with Hexnode UEM + XDR by getting your demo now!

Unify compliance, monitoring, and automated response for complete financial resilience

Watch a DemoFAQs

What is the Digital Operational Resilience Act (DORA)?

DORA is an EU regulation effective January 2026 requiring financial entities to strengthen ICT risk management, incident response, and third-party oversight to ensure operational continuity and cybersecurity resilience.

How do UEM and XDR help with DORA compliance?

UEM ensures device-level compliance, patching, and configuration control, while XDR provides unified detection, response, and reporting. Together, they help financial institutions meet DORA’s continuous monitoring, auditability, and recovery mandates.

Ready to Achieve Real Cyber Resilience?

Start securing your endpoints risk-free. No credit card required. Try Our 14-Day Free Trial!

Signup now